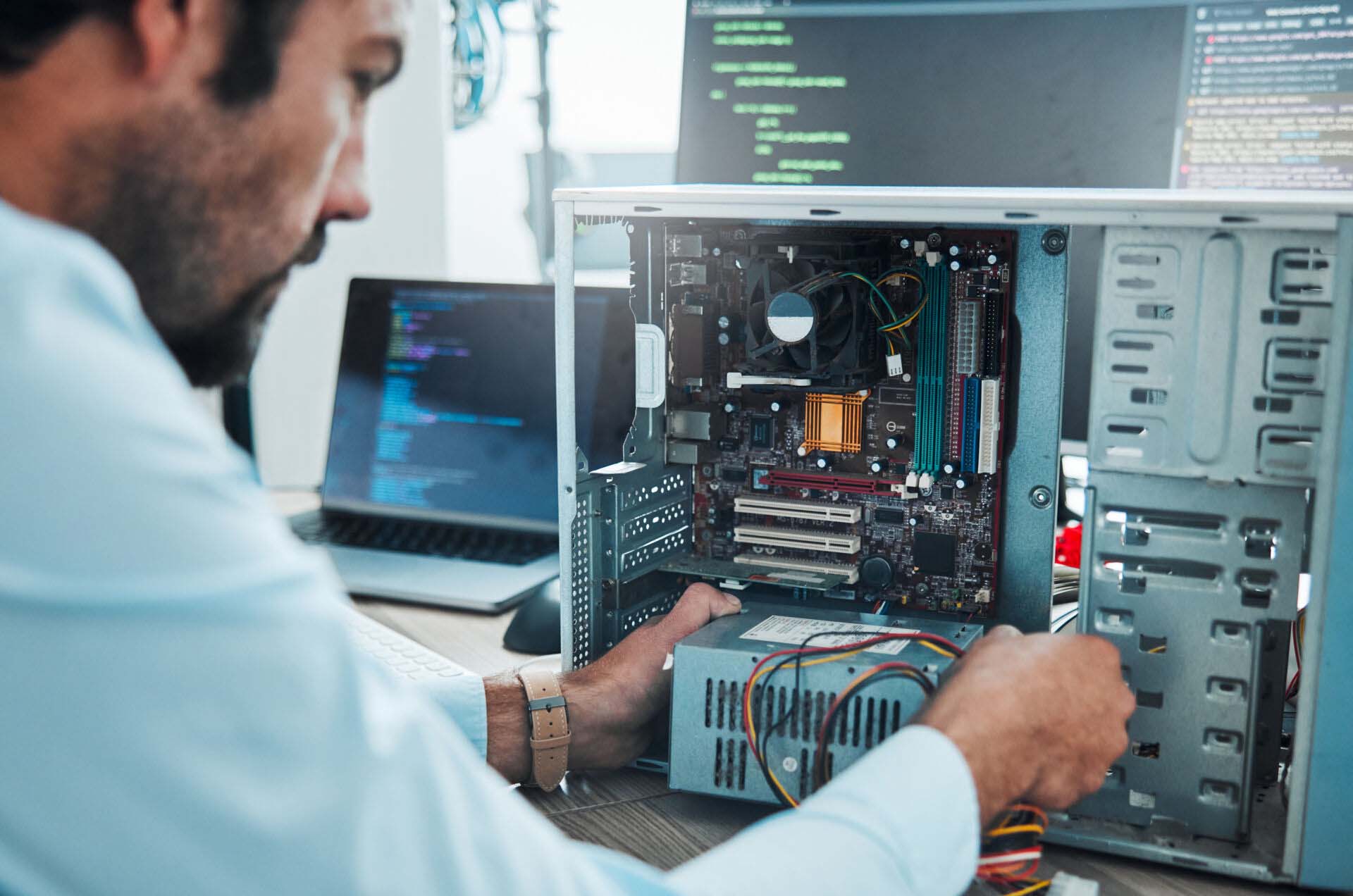

Why PC Builders Need Insurance in California?

As a PC builder, your clients rely on you to deliver flawless, high-performance custom-built systems. However, the technical nature of PC building carries inherent risks. A system crash, a data breach, or hardware failures can lead to significant financial losses, legal issues, and damage to your reputation. Business insurance provides the essential protection you need, covering potential lawsuits, property damage, theft, and other risks, ensuring the stability and success of your business.

Cost of Insurance

The cost of insurance for PC builders varies based on several factors:

- Type of Services Provided

- Value of Equipment and facility

- Business Size and Revenue

- Coverage Limits and Deductibles

- Claims History

How to Get Insurance

Getting insurance for your PC building business is straightforward. Follow these simple steps to secure coverage:

- Complete a Free Online Application: Provide basic information about your company, such as revenue and the number of employees.

- Compare Insurance Quotes: Review quotes from top-rated insurance companies and choose the policies that best meet your needs.

- Pay for Your Policy and Download a Certificate: Once you’ve selected your coverage, pay for your policy and download your certificate of insurance.